How Bookkeeping Calgary prevents costly financial errors

Wiki Article

Exploring the Trick Responsibilities of a Professional Accountant in Financing

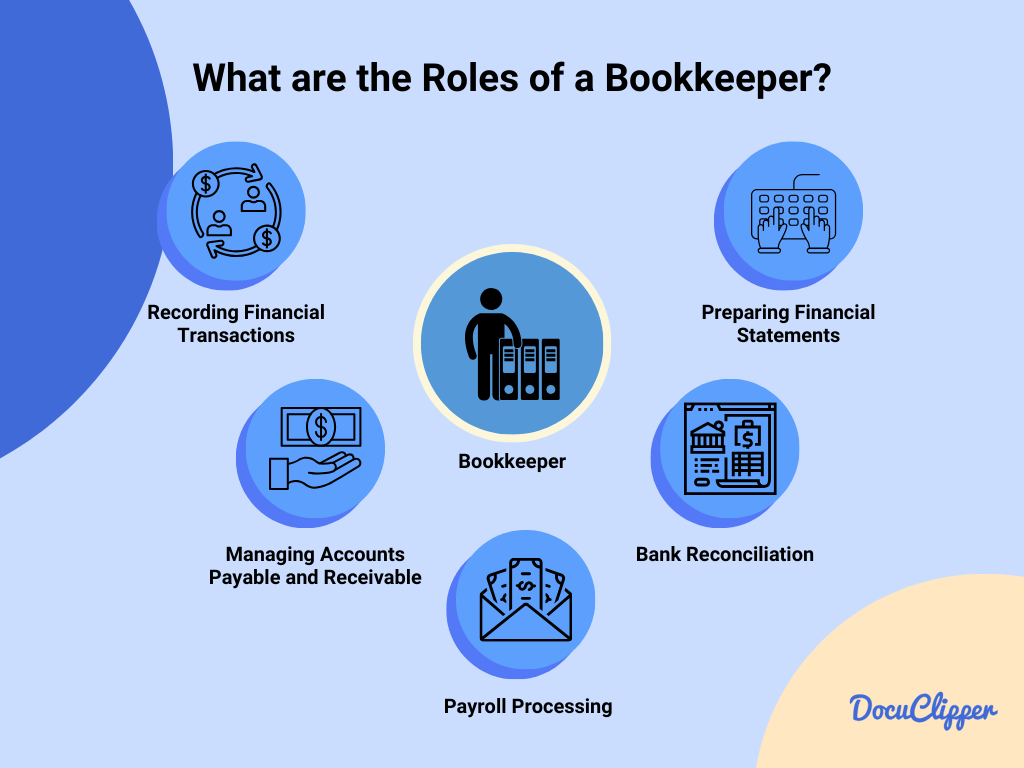

The function of a specialist accountant is essential in the domain name of finance. They are entrusted with preserving exact financial records, managing accounts payable and receivable, and making certain conformity with financial laws. In addition, their duty encompasses preparing financial statements and reports. Each of these responsibilities adds to the financial wellness of an organization. The nuances of their job commonly go undetected, increasing questions regarding the impact of their know-how on more comprehensive monetary techniques.Keeping Accurate Financial Records

Preserving precise financial documents is a critical duty for specialist bookkeepers. This task requires meticulous interest to detail and a detailed understanding of economic principles. Bookkeepers are liable for documenting all monetary transactions, guaranteeing that data is taped continually and properly. They use numerous accountancy software program and devices to simplify the recording procedure, which boosts efficiency and decreases the risk of mistakes.Routine settlement of accounts is vital, permitting bookkeepers to recognize discrepancies and correct them immediately. By maintaining organized and current records, they supply beneficial insights into the monetary health and wellness of a company. This obligation additionally includes the prep work of monetary declarations, which work as a substantial source for administration decision-making. Ultimately, the exact monetary documents kept by accountants sustain conformity with regulative demands and foster trust amongst stakeholders, thereby adding to the general success of the service.

Managing Accounts Payable and Receivable

Properly handling accounts payable and receivable is a crucial facet of an accountant's duty, guaranteeing that a company's capital remains healthy. This responsibility includes tracking inbound and outbound payments, which permits timely payment and collections from customers while likewise guaranteeing that the company satisfies its monetary obligations to vendors and suppliers.

Accountants should maintain accurate documents of invoices, settlement terms, and due days, assisting in effective communication with lenders and clients. By keeping track of these accounts, they can recognize discrepancies or past due accounts, making it possible for proactive steps to deal with concerns before they intensify.

In addition, an accountant's function consists of fixing up accounts to ensure that all financial transactions align with financial institution statements and inner documents. This diligence not only boosts monetary transparency yet likewise sustains strategic monetary planning, permitting the company to designate resources efficiently and maintain a robust monetary position.

Making Sure Conformity With Financial Laws

While guiding through the complex landscape of monetary guidelines, an accountant plays a necessary function in ensuring an organization complies with lawful requirements and standards. This responsibility includes remaining updated on adjustments in tax legislations, conformity requirements, and industry-specific guidelines. Best Bookkeeping Calgary. By meticulously tracking monetary purchases and preserving exact documents, the accountant assists protect against infractions that can bring about fines or legal problemsIn addition, the accountant monitors internal controls to guard against fraudulence and mismanagement. They apply procedures that promote openness and accountability within the financial structure of the company. Collaboration with auditors and governing bodies additionally strengthens compliance initiatives, as bookkeepers supply needed paperwork and support throughout reviews.

Eventually, the commitment to conformity not just secures the company however likewise improves its credibility Homepage with stakeholders, cultivating depend on and stability in its monetary practices.

Readying Financial Statements and News

Preparing monetary declarations and reports is a vital task for accountants, as it gives stakeholders with a clear introduction of an organization's financial health and wellness. Best Bookkeeping Calgary. These papers, which commonly include the balance sheet, income declaration, and cash money circulation statement, sum up the economic tasks and setting of the business over a certain period. Bookkeepers diligently gather, record, and organize monetary data to guarantee accuracy and conformity with relevant accounting requirementsThe preparation procedure entails fixing up accounts, verifying purchases, and readjusting entrances as required. Via this thorough technique, accountants help ensure that financial declarations reflect real state of the company's finances. Furthermore, prompt preparation of these reports is important for effective decision-making by management, investors, and regulatory bodies. By offering clear and precise economic paperwork, accountants play an essential role in maintaining transparency and trust fund within the financial ecological community of the organization.

Offering Financial Insights and Analysis

Accountants evaluate economic information to provide useful understandings that notify calculated decision-making within an organization. By thoroughly evaluating trends in revenue, expenditures, and cash money flow, they assist determine areas for enhancement and highlight potential dangers. Bookkeeping Calgary. These insights enable monitoring to allocate resources better and readjust company strategies as necessary

Additionally, by leveraging monetary software program and analytical devices, accountants can offer information in a clear and understandable format, making it easier for decision-makers to understand intricate financial issues. Eventually, the insights derived from an accountant's analysis empower organizations to make enlightened options that boost productivity and drive development.

Often Asked Questions

What Software Program Tools Do Expert Accountants Typically Make Use Of?

Expert bookkeepers commonly make use of software program devices such as copyright, Xero, Sage, and FreshBooks. These applications streamline financial monitoring, promote exact record-keeping, and improve reporting abilities, enabling efficient handling of financial purchases and data analysis.How Does an Accountant Differ From an Accountant?

A bookkeeper primarily manages everyday economic transactions and record-keeping, while an accountant evaluates monetary data, prepares statements, and provides strategic guidance. Their functions match each other yet focus on distinctive elements of economic monitoring.

What Certifications Are Needed to End Up Being an Accountant?

To end up being a bookkeeper, people typically require a senior high school diploma, proficiency in bookkeeping software, and expertise of fundamental bookkeeping principles. Some might go after qualifications or original site associate degrees to improve their qualifications and job leads.Just How Typically Should Financial Records Be Updated?

Financial records ought to be updated on a regular basis, ideally on a regular or daily basis, to assure precision and timeliness. This practice enables efficient tracking of financial tasks and sustains informed decision-making within the organization.Can a Bookkeeper Help With Tax Obligation Prep Work?

Yes, a bookkeeper can assist with tax preparation by arranging monetary records, making sure exact paperwork, and providing required reports. Their experience assists improve the process, making it easier for tax obligation professionals to total returns effectively.They are tasked with preserving precise financial records, handling accounts payable and receivable, and making certain compliance with economic regulations. Preparing economic declarations and reports is a crucial task for bookkeepers, as it gives stakeholders with a clear overview of an organization's monetary health and wellness. With this detailed strategy, accountants help ensure that monetary statements reflect the real state of the organization's funds. By leveraging economic software application and logical devices, accountants can present information in a clear and comprehensible format, making it much easier for decision-makers to comprehend complicated financial problems. An accountant primarily takes care of everyday financial purchases and record-keeping, Recommended Reading while an accountant analyzes monetary data, prepares declarations, and provides tactical advice.

Report this wiki page